Telefon:

+48 512 586 949

It means that if a company sells a product on credit, it will still recognise the revenue from the sales at the time of the sale, even though it has not yet received payment. The grounds behind this principle is that businesses should only be required to record revenue when they have actually earned it, regardless of when they receive payment. Accrued revenue, sometimes called deferred revenue, occurs when a company has made a sale but hasn’t received payment from the customer. The sale is counted as revenue, even though the money doesn’t actually exist yet in the company’s bank account. Accrued revenue can happen if there’s a trial period before full payment is due from the customer, or from delayed interest on investments. Revenue is the culmination of a firm’s earnings from its core business activities—product sales and services rendered.

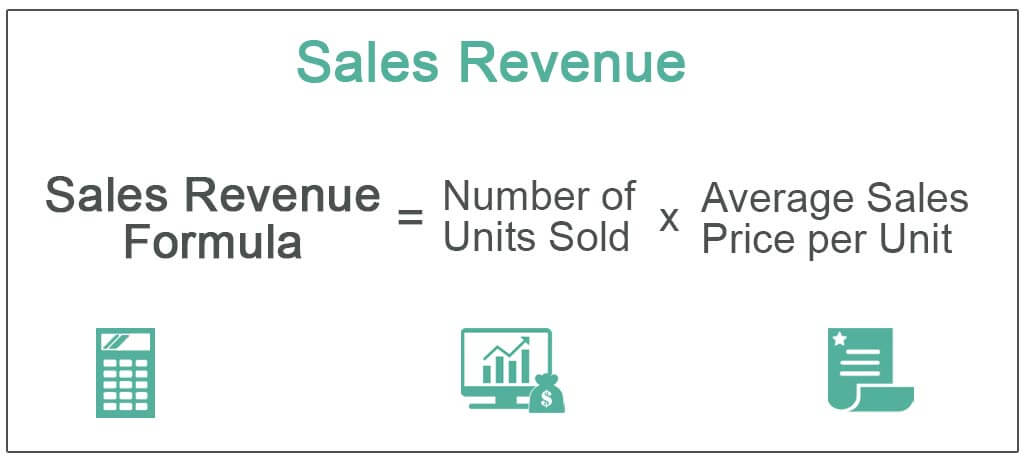

How to Calculate Revenue: Examples and Explanations

Note that some components (i.e. discounts) should only be subtracted if the unit price used in the earlier part of the formula is at market (not discount) price. It is an unfiltered amount of money—the gross amount earned by an organization how to find revenue in accounting or a government without accounting for deductions. In other words, it is the inward flow of cash generated from business activities. Moreover, it reflects the financial standing of a business— gross sales represent a positive cash flow.

Showing You Understand Revenue on Your Resume

- For instance, a school supply shop sells different products like notebooks, pencils, and pens at different prices.

- Calculating accounting profit is a fairly simple process and should be a regular part of your business strategy.

- Since businesses normally expand by generating more income, it’s also a crucial indicator of business growth.

- Accrued revenue is the term given to revenue that is earned by a company.

Total revenue may also include interest and dividends from investments. Non-operating revenue is received from any side activities your business performs. An example would be selling some of your equipment or vehicles that you don’t need. The money from those sales would be non-operating revenue because such sales would not constitute regular, steady revenue from operations. Total revenue translates directly into gross profit after the cost of goods sold is removed.

to understand.

Non-operating revenue is income from anything other than the company’s primary source of funds. So, like the above example, an auto manufacturer that sometimes sells merchandise counts revenue from merchandise sales as non-operating revenue. Sales revenue has earned its position at the top line of all income statements.

Examples Using Revenue Formula

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Net income, on the other hand, is the final amount of money that a company earns. Google accounts for over 90% of all internet searches, and 46% of those searches are for local businesses. You may improve your company’s visibility by changing your Google My Business listing. One of the first figures someone will focus on when starting a business is revenue, and for good reason.

Once you have figures for both the total revenue and explicit costs, simply subtract costs from revenue, and you’ll know your accounting profit. It is important to note that many people use the term income to mean revenue. Perhaps a business owner sees money “coming in” from customers and logically refers to it as “income”. You can also mention your familiarity with financial statements since revenue is a key piece of these reports. Additionally, if you don’t have any professional experience using revenue or financial statements, you can talk about your experiences with them in school or your personal life. For instance, include experiences like calculating revenue for a friend or family member’s small business.

This could include things like total inventory, employee wages or salaries or paying vendors and suppliers. There can be several different ways to look at revenue within your accounting processes. Some different metrics are going to provide value to different business owners. Profit margins, of course, are one of the biggest metrics for you to measure and monitor.